Wound Care Insurance Coverage: A Practical Guide to Medicare, Costs, and Mobile Care

Insurance for wound care can feel complicated. This guide breaks down what Medicare and private insurers commonly cover, what costs you might expect, and how mobile wound care — including services from Healix360 Advanced Mobile Wound Care Specialists — brings advanced treatment to your home. Read on to learn how Medicare works, what private plans may cover, typical billing practices, and practical steps to verify coverage for wound care.

What Does Medicare Cover for Wound Care Services?

Medicare offers important coverage for many wound care services, especially for chronic or non-healing wounds. Knowing what Medicare covers helps you and your care team choose treatments that are both clinically appropriate and likely to be reimbursed.

Because Medicare is a primary payer for many patients with chronic wounds, its coverage decisions have a big impact on access to treatment for patients and providers.

Medicare Coverage Decisions for Wound Care

As the largest U.S. payer for chronic wound care, Medicare’s decisions influence which wound products, procedures, and services are covered and under what conditions.

Medicare coverage decisions for wound care products, procedures, and services: An overview, 2011

How Does Medicare Part B Support Mobile Wound Care?

Medicare Part B helps cover medically necessary services delivered in the home, assisted living, or skilled nursing settings. That includes initial evaluations, individualized treatment plans, and follow-up visits for chronic wounds. Mobile wound care can reduce the need for hospital trips and is especially helpful for people with limited mobility or transportation challenges.

What Wound Care Supplies and Treatments Are Included in Medicare Coverage?

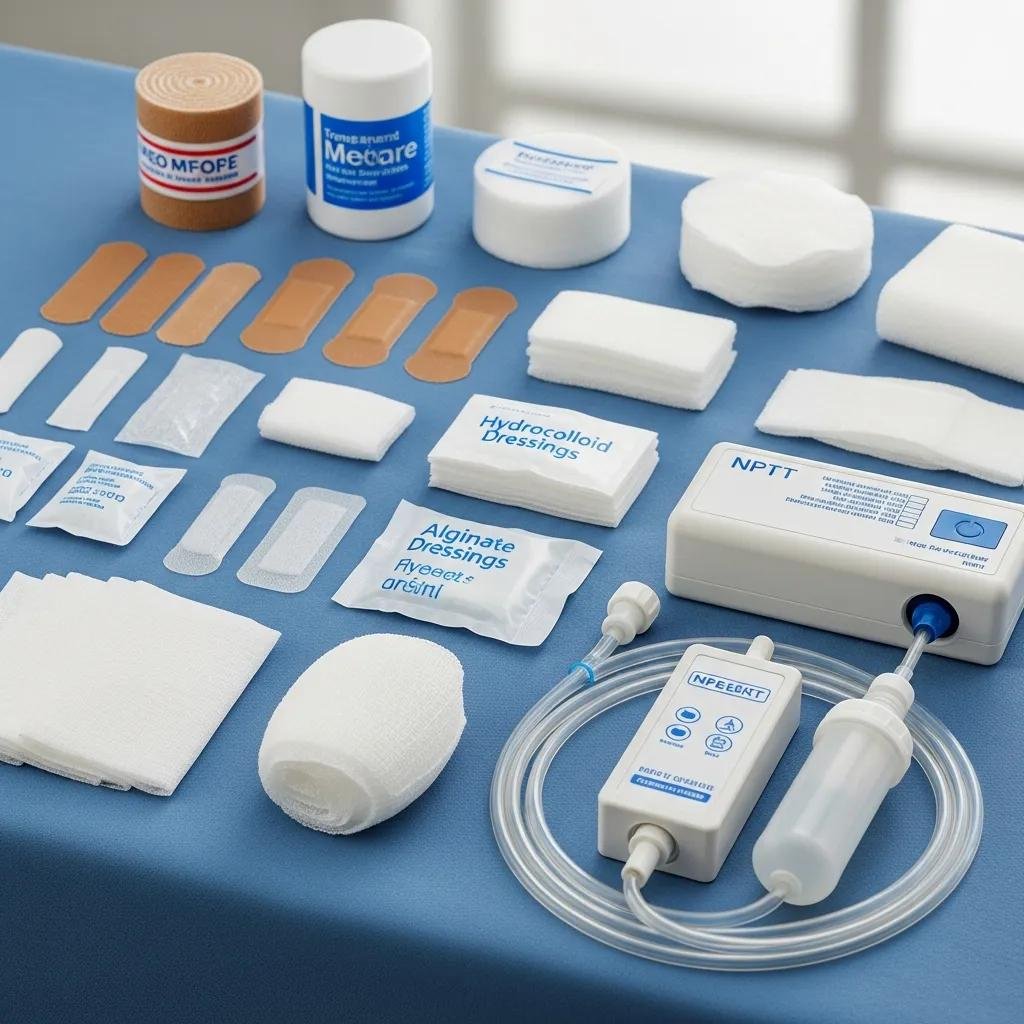

Medicare covers a range of wound care supplies and clinically indicated treatments. Commonly covered items include:

- Dressings: A range of dressings used to manage moisture and protect healing tissue, such as hydrocolloids and alginates.

- Debridement: Procedures to remove dead or nonviable tissue, which are often required for wounds to heal.

- Negative Pressure Wound Therapy (NPWT): A device-based treatment that applies controlled suction to promote wound healing in appropriate cases.

Knowing which supplies and services are typically covered can help you and your provider plan care that aligns with Medicare rules.

How Do Private Insurance Plans Cover Wound Care?

Private insurance plans also cover many wound care services, but coverage varies by policy and insurer. It’s important to check plan details so you understand any limitations, prior authorization rules, or network requirements.

What Are Common Private Insurance Policies for Wound Care Coverage?

Private plans often include:

- In-home care services: Some plans cover mobile wound care visits delivered by licensed clinicians, similar to Medicare.

- Wound care supplies: Coverage for dressings and related supplies is common, though plans may limit quantities or brands.

Always review your individual policy to confirm what’s covered and whether any authorizations are required.

How Can Patients Navigate Private Insurance for Wound Care?

Navigating private insurance becomes easier with a clear process. Try these steps:

- Review your policy: Check benefits, limits, and in-network rules for home or outpatient wound care.

- Contact your insurer: Ask direct questions about coverage, prior authorization, and any documentation they need.

- Keep detailed records: Save treatment notes, invoices, and all communications to support claims or appeals.

Following these actions helps you avoid surprises and speeds up approvals when care is needed.

Understanding Wound Care Insurance: Medicare, Costs & Mobile Care

Understanding common cost drivers and how billing works will help you plan for wound care expenses and reduce the chance of unexpected bills.

Medicare claims processing can be complex — denials happen, and they can create extra administrative work and costs for providers.

Medicare Wound Care Claim Processing Costs

Many CMS wound care claims are processed by a Part A/B or DME MAC contractor. When claims are denied as unpayable, clinics can face added office processing costs — often $25–65 or more per claim.

How to optimise revenue in wound care: a short guide, 2021

How Do Deductibles, Copays, and Coinsurance Affect Wound Care Expenses?

Your out-of-pocket cost depends on several common insurance terms:

- Deductibles: The amount you pay before insurance begins sharing costs.

- Copays: Fixed fees you pay for specific visits or services.

- Coinsurance: The percentage you owe after meeting your deductible.

Reviewing these elements in your plan helps you estimate likely costs for ongoing wound care.

What Are the Key Billing Codes and Medical Necessity Criteria for Wound Care?

Billing for wound care uses specific codes that describe the service provided. Common codes include:

| Billing Code | Description | Medical Necessity |

|---|---|---|

| 97597 | Debridement of wounds | Required for non-healing wounds |

| A6204 | Hydrocolloid dressing | Necessary for moisture retention |

| 97605 | NPWT application | Indicated for complex wounds |

Accurate documentation of medical necessity is key to successful reimbursement for these services.

Medicare reimbursement rules — including NCCI edits — can affect whether multiple outpatient procedures performed in a single encounter will be paid.

Medicare Reimbursement for Outpatient Wound Care

NCCI edits determine whether two outpatient wound care procedures performed during the same encounter will be reimbursed by Medicare. These edits apply to many wound care services.

Top 10 Medicare reimbursement regulations currently impacting wound care practices, 2017

How Can Patients Access and Verify Their Wound Care Insurance Coverage?

Verifying coverage before treatment reduces delays and unexpected costs. Here’s how to confirm eligibility and benefits for wound care services.

What Is the Process to Verify Wound Care Insurance Eligibility?

Follow these steps to check your coverage:

- Contact your insurance provider: Ask about coverage for the exact wound care services you need.

- Provide necessary information: Be ready with diagnosis details, expected treatments, and provider information.

- Request written confirmation: Ask for benefit verification in writing for your records.

Getting written confirmation helps prevent misunderstandings later.

How to Obtain Prior Authorization for Advanced Wound Treatments?

Some advanced treatments require prior authorization. A typical process looks like this:

- Consult your healthcare provider: Your clinician documents medical necessity and recommends the treatment.

- Submit a request to your insurer: Include clinical notes, photos, and any required forms.

- Follow up: Track the request and respond quickly to any insurer questions to avoid delays.

Clear documentation and persistent follow-up make approvals more likely and faster.

Which Specific Wound Care Treatments Are Covered by Insurance Plans?

Coverage varies, but many plans will pay for clinically appropriate advanced wound therapies when medical necessity is documented.

Is Insurance Coverage Available for Biologic Dressings and Skin Substitutes?

Many insurers cover biologic dressings and skin substitutes for complex wounds when a provider demonstrates they are medically necessary. These products can speed healing and reduce complications — confirm coverage and authorization requirements with your insurer before treatment.

Does Insurance Cover Negative Pressure Wound Therapy and Debridement?

NPWT and debridement are commonly covered when they meet medical necessity criteria. Make sure your provider documents the clinical indications clearly to support coverage and reimbursement.

What Support Is Available for Patients and Caregivers Regarding Wound Care Insurance?

Patients and caregivers can tap several resources to manage coverage questions and appeals.

How Can Patients Appeal Denied Wound Care Insurance Claims?

If a claim is denied, take these steps to appeal:

- Review the denial letter: Note the denial reason and any required next steps.

- Gather supporting documentation: Collect clinical notes, test results, and treatment records that justify medical necessity.

- Submit an appeal: Follow the insurer’s appeals process and include all supporting documents.

A well-documented appeal improves your chances of overturning a denial.

What Resources Help Caregivers Manage Wound Care Insurance?

Caregivers can use these supports:

- Support groups: Peer communities offer practical tips and emotional support.

- Educational materials: Reliable guides explain claims, authorizations, and patient rights.

- Professional guidance: Speak with clinicians or insurance specialists to clarify coverage and next steps.

These resources help caregivers advocate effectively and keep care on track.

Frequently Asked Questions

What should I do if my wound care claim is denied?

Start by reading the denial letter to understand the reason. Collect all clinical records and notes that support the service’s medical necessity, then submit an appeal following your insurer’s process. Keeping organized records and clear clinical documentation improves your chances of a successful appeal.

Are there any out-of-pocket costs associated with wound care services?

Yes. Out-of-pocket costs can include a deductible, copays, and coinsurance — the exact amounts depend on your plan and the services provided. Review your policy or call your insurer to estimate expected costs before treatment.

How can I find a mobile wound care provider covered by my insurance?

Ask your insurer for an in-network provider list and check with your primary clinician for recommendations. Once you have a provider, confirm they accept your insurance and whether any prior authorization is required before the first visit.

What types of advanced wound care treatments require prior authorization?

Treatments that commonly require prior authorization include NPWT, biologic dressings or skin substitutes, and certain surgical procedures. Your provider should submit supporting clinical documentation to justify the treatment’s medical necessity.

How can I keep track of my wound care treatments and insurance claims?

Keep a simple record of every visit, treatment, and bill — note dates, provider names, services, and any communications with your insurer. A spreadsheet, notebook, or digital app works well and makes appeals and follow-ups much easier.

What resources are available for caregivers managing wound care insurance?

Caregivers can rely on support groups, educational resources from trusted organizations, and professional advice from clinicians or insurance experts. These tools help you understand benefits, manage claims, and advocate for the patient.

Conclusion

Understanding wound care insurance — from Medicare rules to private plan differences — makes it easier to get the right treatment without unexpected bills. Verify coverage early, document medical necessity, and appeal denials when appropriate. If you need help, explore our resources or reach out to a Healix360 specialist to guide your wound care journey.